Illinois Hard Currency Financing Apps & Home Funding

Articles

- Taking a look at profitable residential real estate investment communities inside 2024

- We are able to help the after the borrowers with the IL difficult money needs:

- Whenever i are prequalified, how quickly should i get a proof Financing letter?

- Investing in Single Loved ones Property As opposed to Multi-Device Functions

The brand new otherwise young investors could possibly get were only available in Chicago a home from the home hacking – to purchase a Vanguards casino review small multifamily possessions and you can residing one device when you are renting the others. For example, one can possibly pick a good $425,000 step 3-flat within the 2023 in the an up-and-upcoming neighborhood such Auburn Gresham, live in you to definitely tool and rent one other a couple for $step 1,300-1,600 a month to cover mortgage. While this large wedding strategy have more dangers than commercial possessions spending, it allows traders to enter the market having reduced investment.

The genuine home business inside Illinois might have been increasing from the an excellent rapid rate, for both buy-and-hold borrowers and boost-and-flip buyers. No matter your future investment endeavor, EquityMax really wants to end up being the difficult loan provider to assist which have your entire owning a home needs. On the higher Chicago area, Make condition as well as shorter metro components within the condition, EquityMax could offer aggressive cost and you may conditions so that our very own subscribers make a profit with each and every purchase.

Taking a look at profitable residential real estate investment communities inside 2024

You can find unique possibilities and demands inside the Chicago and its own buyers try taking advantage and dealing with them of them each day. We feel inside building a collective relationship with our clients, getting flexible options customized for the needs. We’lso are purchased trustworthiness and stability, so you is also believe that your particular hard currency loan terms was fair and you will obviously conveyed at the beginning. We assures our clients pay low-rates to prevent the brand new finance away from as a financial burden. We’ll take a look at assembling your shed package and you may economic documents and supply attention costs that are as little as you are able to. Here are a few our simply-financed enterprise part for additional info on all of our loan sale.

We are able to help the after the borrowers with the IL difficult money needs:

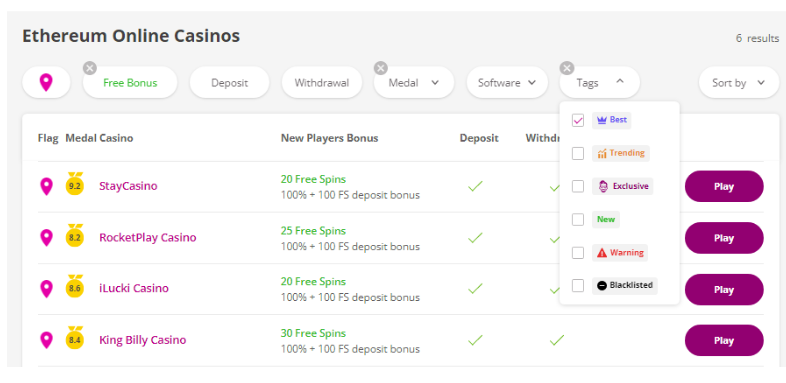

They generally give a portion of one’s ARV to ensure the investment’s earnings and security. Finding the right tough currency loan providers in the Chicago is critical to help you your own a house using achievements. Whether you’re a new comer to a home otherwise tend to be more knowledgeable, the tough money fund can be wind up costing you a large number of dollars for many who aren’t careful. A detrimental tough money financing is also run you many and several thousand dollars.

Chicago also offers a variety of investment opportunities for buyers having varying chance tolerances and budgets. Have the Hard Money Advisor $250 disregard and now have numerous also offers from our required listing of difficult money loan providers for your next enterprise. Renovo is highly rated on google while offering an excellent choices of mortgage applications. They has more 10 years running a business and you can consider themselves a good One-stop Go shopping for Solitary Members of the family and you will Multi-Family people.

Rising home values and you will a life threatening miss in the unemployment cost (ten.4% to help you 6.8%) mean that the market effects of 2020 are earlier, and 2021 appears to be a banner 12 months to own investing. We’ve rehabbed, ended up selling and you can rented investment services ourselves. We understand what things to see in order to rest assured your enterprise will result in cash.

Start off today with your totally free Line of credit to see what a lot of almost every other Illinois a house people features–you to definitely handling Lima You to Funding is the greatest experience a good a property trader will get. Lima You to definitely Investment are purchased helping Illinois a home investors on the greatest owning a home money offered. That being said, they have more than fifty yearss of experience in the business and you may has efficiently caused of many a home buyers typically. For those who’re trying to bring your home assets inside Chicago, IL, to the newest heights, the important credit characteristics would be the stimulant you want.

Get a trader-amicable real estate agent that will help you to get access to off-business functions at a discount and you may evaluate potential local rental money founded for the field fashion. HomeLight is connect you with investment property professionals at no cost. As among the better tough money loan providers in the Chicago, i focus on buyers each day that looking for foreclosures opportunitites.

I became really satisfied with the borrowed funds procedure that I am today to my 2nd mortgage for the organization. While it is a little package at the $15,100, there are pair lenders, apart from EquityMax, that may offer a loan of this proportions. Illinois have among the high foreclosure rates in the nation which gifts of a lot options to have buyers to help you safer sales lower than market really worth plus force for pre-foreclosure/short selling acquisitions.

Whenever i are prequalified, how quickly should i get a proof Financing letter?

For these offered a secondary family, Chicago offers book opportunities. Communities for example Lakeview Eastern, featuring its bright surroundings and you can distance on the lakefront, stick out. Key phrase queries such ‘best metropolitan areas to purchase a vacation household in the Chicago’ is book investors to the these types of fashionable urban centers. Hard money credit inside the Chicago offers the fresh versatility going immediately after unique investment options you to banking institutions obtained’t touching. We looked at hard money’s plans and you can displayed her or him the thing i are trying to manage and only that way it caused it to be you are able to.

While the house would be really worth $300,000 following the solutions, the lender usually commit to money around 75% of this value. For those who’ve got difficulties delivering that loan of a financial or you would like to close off a deal prompt, difficult money lending inside Chicago could be the best option to possess your. Are rehabbers ourselves, this is a huge benefit to the consumers as we know what pressures of several borrowers come across whenever referring to lenders and you can we try to make sure those people try averted without exceptions.

EquityMax have multiple consumers with lots of effective money within portfolio. EquityMax doesn’t need all of our individuals becoming a business of LLC. We are able to originate finance to individuals, LLCs, Organizations, House Trusts, and Mind-Led IRAs. As a result of our very own Purchase Before you Promote program, HomeLight can help you discover a fraction of their equity upfront to place for the your following house. Then you’re able to generate a strong render in your second home without house sale backup.

Investing in Single Loved ones Property As opposed to Multi-Device Functions

Tough money finance are best fitted to Chicago a property traders who want fast access to help you finance, specifically for ideas with punctual recovery minutes or whenever old-fashioned financing isn’t an option. Tough currency lenders Chicago are also able to offer a lot more flexible terms than simply antique lenders since the hard currency fund often don’t require employment confirmation otherwise credit monitors. As a result actually individuals with less than perfect credit ratings otherwise restricted income can invariably qualify for hard money financing whenever looking to money options within the Chicago. We have found a list of personal money lenders for real property within the Chicago – the fresh Circle, Edison Playground, Roscoe Town, Beverly, Lakeshore Eastern, Rockwell Crossing, Bridgeport, or any other portion. Have fun with a personal financial to get quick money for a good Chicagoland money spent pick, refinance, otherwise equity cash out.

About Elizabeth

My mission is to guide you to break through old patterns and learn your soul’s lessons so that you can believe in yourself, live in the truth of who you are, and design a lifestyle you’re in love with.

When you trust in yourself and align with your soul, you masterfully manifest a life you love.

Find out if you’re ready to get unstuck and back on track