Resident Defense Put Definition

Content

Most of the time, the occasions the brand new alien is in the United states since the a good teacher, college student, otherwise trainee for the a keen “F,” “J,” “Yards,” otherwise “Q” charge commonly counted. For the revealing requirements out of QIs, see Mode 1042-S reporting and you can Cumulative reimburse tips, discussed afterwards less than Qualified Intermediary (QI). An organization get apply for QI status from the Irs.gov/Businesses/Corporations/Qualified-Intermediary-Program. Quite often, a foreign effortless trust is actually a different trust that is required to spread each of the earnings a-year. A foreign grantor trust are a different believe that is handled while the an excellent grantor faith below parts 671 thanks to 679. Transfers from welfare in the partnerships engaged in the newest perform from a You.S. change otherwise company.

- In which a guy carries on organization thanks to a permanent establishment in the Canada and because of another permanent institution external Canada, the new import away from assets or leaving from a support by one permanent institution to a different may be deemed getting a provision and could be subject to the newest GST/HST.

- Unless you document a proper and you will complete Form 1042 or Function 1042-S to the Irs on time or if you don’t provide a correct and done Form 1042-S on the recipient on time, you happen to be susceptible to a penalty.

- The brand new facility for premature withdrawal of dumps will never be offered where money against such as places are availed out of.

- (4) The brand new maintenance by a property owner or transferee away from a payment otherwise deposit otherwise one bit thereof, inside solution associated with the part and with absence of good-faith, will get subject the new landlord or his transferee to help you damage to not go beyond 200 (2 hundred.00) as well as any real damages.

- See Irs.gov/SocialMedia to see various social media equipment the newest Irs spends to express the fresh information on income tax alter, ripoff notification, attempts, items, and characteristics.

Director’s orders: see to finish tenancy

It continues on positioned the necessity one people who own an enthusiastic helped property development offer clients the choice to possess their leasing repayments said to one user reporting company. Landlords can charge clients the real prices, not to exceed ten monthly, to cover price of reporting. (d) A landlord who goes wrong both to go back a security put otherwise to include a created breakdown and you can itemization of write-offs on the otherwise through to the 30th go out following time the new tenant surrenders fingers is actually believed to possess acted inside bad trust. (a) A property manager just who inside the bad faith holds a protection deposit within the ticket for the subchapter is likely to own a cost equal to the sum of the one hundred, 3 x the new part of the put wrongfully withheld, and also the tenant’s reasonable attorneys’s charges inside the a healthy to recoup the fresh deposit. The fresh bad faith maintenance of a deposit otherwise people part of a deposit by a lessor away from residential properties inside the admission from so it part, in addition to inability to own authored statement and itemized bookkeeping necessary by this area, should topic the brand new lessor so you can punitive injuries not to exceed a couple of hundred or so dollars. The responsibility from proof of genuine injuries as a result of the brand new occupant to your leasehold site will be on the landlord.

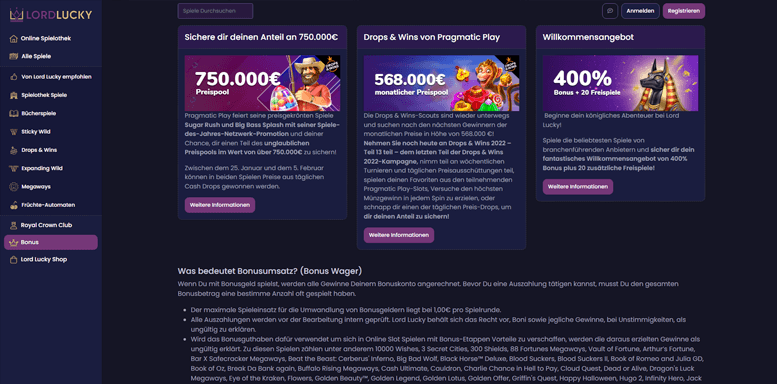

When you’ https://happy-gambler.com/black-gold/ re a best owner, a collaboration, otherwise an S corporation, you can see your own tax details about checklist on the Irs and you will create a lot more having a corporate income tax membership. Somebody paid off to set up tax statements for other people have to have a thorough knowledge of taxation issues. For additional info on choosing a taxation preparer, visit Strategies for Opting for a tax Preparer on the Internal revenue service.gov.. A great “reporting Design 1 FFI” are an enthusiastic FI, as well as a different branch away from a great U.S. lender, managed as the a reporting lender below an unit step 1 IGA. All of the programs to own withholding certificates need make use of the after the structure. Every piece of information must be provided within the sentences labeled to correspond with the brand new number and you may emails set forth lower than.

Wages Paid back so you can Group—Graduated Withholding

A foreign partnership you to definitely dumps a great USRPI get borrowing the newest fees withheld because of the transferee against the tax accountability determined below the relationship withholding on the ECTI legislation. A shipment away from a domestic company that’s an excellent You.S. real-estate holding firm (USRPHC) is generally susceptible to section step three withholding and you may withholding within the USRPI provisions. In addition, it pertains to a company that was a USRPHC in the when within the smaller of your several months when the newest USRPI occured, or even the 5-seasons several months stop to the go out out of temper. A good USRPHC can also be see one another withholding provisions if it withholds under among the following the actions.

Personal

(5) The new director get will not undertake a software to have overview of a choice otherwise order of your manager if your application do not conform to subsection (3). (2) A demand referred to inside the subsection (step one.1) (b) is generally generated without warning to some other people, however the movie director can get acquisition one another party be provided with find. (c) you to accurate documentation maybe not served in accordance with part 88 otherwise 89 are well enough considering otherwise supported for purposes of so it Work.

An excellent PTP who may have ECTI must pay withholding tax under section 1446(a) on the people distributions of that income built to its international partners. An excellent PTP need explore Versions 1042 and 1042-S (Earnings Code 27) to help you report withholding from PTP withdrawals. The interest rate away from withholding is actually 37percent to possess noncorporate lovers and you will 21percent to possess business partners less than point 1446(a). Around three versions are essential to own revealing and you can investing more than tax withheld on the ECTI allocable to help you overseas couples. The U.S. and you may overseas withholding broker need file an application 1042-S for amounts at the mercy of chapter step 3 withholding and you may section cuatro reportable quantity unless of course an exclusion can be applied. Because the withholding representative, in some instances you need to consult that the payee provide you with with its U.S.

How to handle it for those who overwithheld income tax hinges on once you discover overwithholding. For individuals who owe a punishment to possess failing to put tax to possess more than one deposit several months, and you build in initial deposit, your own put try applied to the most recent months to which the newest deposit applies unless you specify the new deposit several months otherwise periods to which your own deposit is going to be used. You may make it designation merely throughout the a great 90-go out several months one to starts to the time of one’s punishment observe.

- Throughout circumstances, charge for shipping products are susceptible to the new GST/HST based on the typical GST/HST laws you to connect with including services.

- We will monitor one’s share place to see the brand new readily available TFSA share space for each and every qualified personal centered on guidance given per year because of the TFSA issuers.

- Constantly try to resolve your trouble for the Irs earliest, but when you is’t, following come to TAS.

- Under particular conditions, the brand new provincial part of the HST is not placed on merchandise produced to the an excellent playing province.

What Landlords Would like to know On the The new Tenant Tests Regulations*

If you (or even the substitute) are needed by the laws to help you furnish a duplicate of your certification (or declaration) for the Irs and you (or even the replace) don’t exercise in the some time trend recommended, the newest degree (otherwise declaration) isn’t energetic. The newest skills inside things (3) and (4) aren’t energetic for individuals who (or perhaps the qualified substitute) provides real training, otherwise found a notification out of a realtor (or replacement), that they’re untrue. This also applies to the new licensed substitute’s declaration under goods (4).

Calculating your internet taxation

If you opt to create your fee in the foreign finance, the new rate of exchange you will get for changing the fresh fee to help you Canadian bucks will depend on the bank running your payment, that will vary on the rate of exchange the CRA uses. You really need to have a long-term business inside Canada to make use of the brand new short strategy. Specific registrants usually do not utilize the small approach, in addition to solicitors (or law offices), accounting firms, bookkeepers, monetary professionals, and detailed financial institutions (for the complete list, see ‘’Exceptions’’ under ‘’Quick type of accounting’’ within the Guide RC4022, General Suggestions for GST/HST Registrants). Underneath the a few-year limitation, you might claim the ITCs on the any future return that is filed by deadline of the come back during the last revealing months you to definitely ends within two years pursuing the prevent away from your own fiscal 12 months filled with the newest revealing months where ITC could have basic been claimed.

About Elizabeth

My mission is to guide you to break through old patterns and learn your soul’s lessons so that you can believe in yourself, live in the truth of who you are, and design a lifestyle you’re in love with.

When you trust in yourself and align with your soul, you masterfully manifest a life you love.

Find out if you’re ready to get unstuck and back on track